Acquihire 2.0: The New Way Big Tech Kills AI Startups

What Windsurf, Scale AI, and Character AI deals have in common

Big Tech isn't acquiring AI startups anymore. They're acquiring the people who built them. And they silently kill these startups in the process.

Three major AI deals in the past year tell the story. Windsurf's founders are joining Google. Scale AI's Alexandr Wang moved to Meta. Character AI's co-founders landed at Google too. None of these were traditional acquisitions. They were dressed up as partnerships or investments. But they were something else entirely.

Welcome to Acquihire 2.0.

The Old Playbook Is Dead

Remember when Google bought DeepMind for $500+ million? Or when Facebook acquired WhatsApp for $19 billion? Those days are over in AI.

Today's playbook looks different. Big Tech companies avoid buying products, IP, or entire companies. Instead, they announce “strategic partnerships”, “investments” or “licensing deal” and quietly extract the core team. The startup gets silently killed. The founders get rich. Most others get nothing.

Why the shift? Three reasons.

Antitrust pressure. Regulators are watching every major acquisition with a microscope (ex: Adobe’s acquisition of Figma fell through). Buying a hot AI startup means DOJ and the European Commission investigations. But announcing a "partnership" or "investment" while the team quietly joins your company? That's just business development. (though DOJ is now probing the Character AI deal)

Speed to talent. Top AI talent likely don’t respond to recruiter LinkedIn messages. But offer the founder a quiet deal and suddenly the entire R&D team walks into your office on Monday. No six-month recruiting cycle. No competing offers. Just instant access to the people who built the thing you wanted to buy.

It's cheaper. No messy cap tables. No (or limited) investor payouts. No inflated startup valuations. Just a team, some code, and an offer letter.

The Winners and Losers

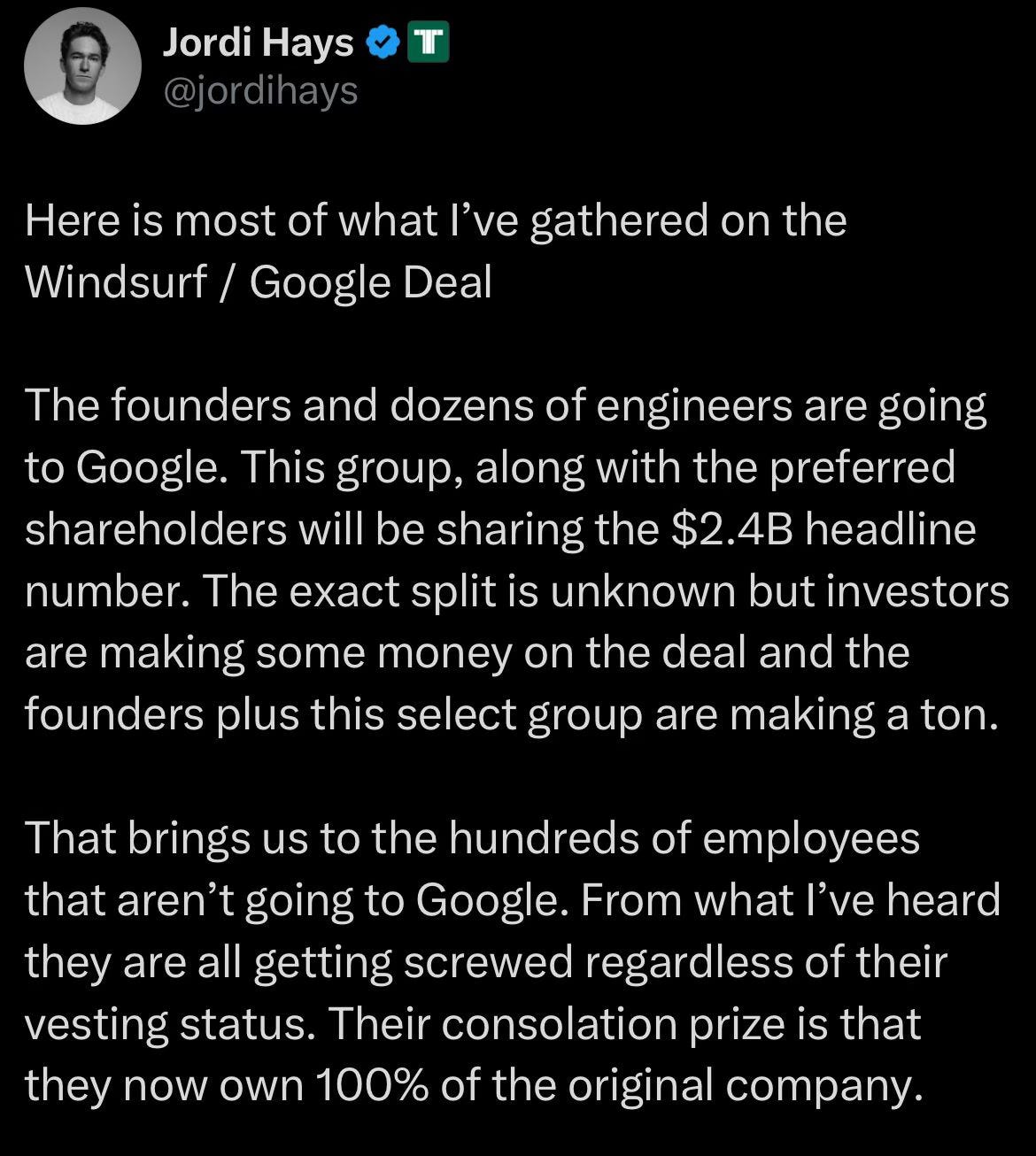

This works great if you're the founder or core engineering team that’s joining. You get a soft landing at a tech giant. Your equity converts to cash or stock. You avoid the stress of running a startup.

But what about everyone else?

The reality is more nuanced but still problematic. Yes, some employees get some payout from these deals. But founders get life-changing money while everyone else gets either nothing or small bonuses.

What happens to the companies left behind? The startup gets silently killed (except Windsurf just got "saved" by Cognition coming in as a white knight after Google poached their founders). No traditional exit announcement. No press release celebrating the team's hard work. Just a headline partnership announcement that obscures what really happened.

What This Means for You

If you're joining an AI startup, ask hard questions. What happens if the founders get acquihired? Do you believe the founders will look out for you and the other employees? Are you betting on the company's success or just subsidizing the founders' exit strategy?

If you're building an AI startup, understand the new rules. Big Tech may want your team, not your company. But negotiate a deal for your employee too, because they were there from the beginning, believing in your mission and contributing to your success.

If you're an investor, price this risk into your deals. Most AI startups won't go IPO or get acquired traditionally. Even successful ones might end in acquihires that only enrich founders. Evaluate founder character - will they take care of their team or just themselves?

The Bigger Picture on Talent

Acquihire 2.0 reveals something important about AI competition. The people are the most important moat.

Big Tech companies have infinite money and computing power. What they lack is the specific expertise to accelerate the development of cutting-edge AI products.

So they buy the expertise. Not the company. Not the product. Just the people.

Is this efficient resource allocation? Or is it quiet collapse dressed up as success? The line between those two things is thinner than most people realize.