Profitability vs Growth: A Dilemma For Startups

Key Considerations for Determining the Optimal Strategic Focus

As an investor of early-stage startups, I've seen how attitudes about growth versus profitability in Silicon Valley have changed over the past year. Investors have grown more cautious, while founders are much more focused on burn and profitability metrics even early on. The "growth first" mentality has given way to profitability.

How should founders and VCs strategically decide when to blitzscale versus when to focus on profitability? I don't think there's a one-size-fits-all answer. The right approach depends on factors like market dynamics, access to capital, business model, and the stage of the business. In the sections below, I will outline key considerations for weighing growth versus profitability, such as:

When to prioritize profit?

When to prioritize growth?

What are examples of companies that focused on profit vs. growth first?

What growth and profitability metrics to track?

When to Prioritize Profit?

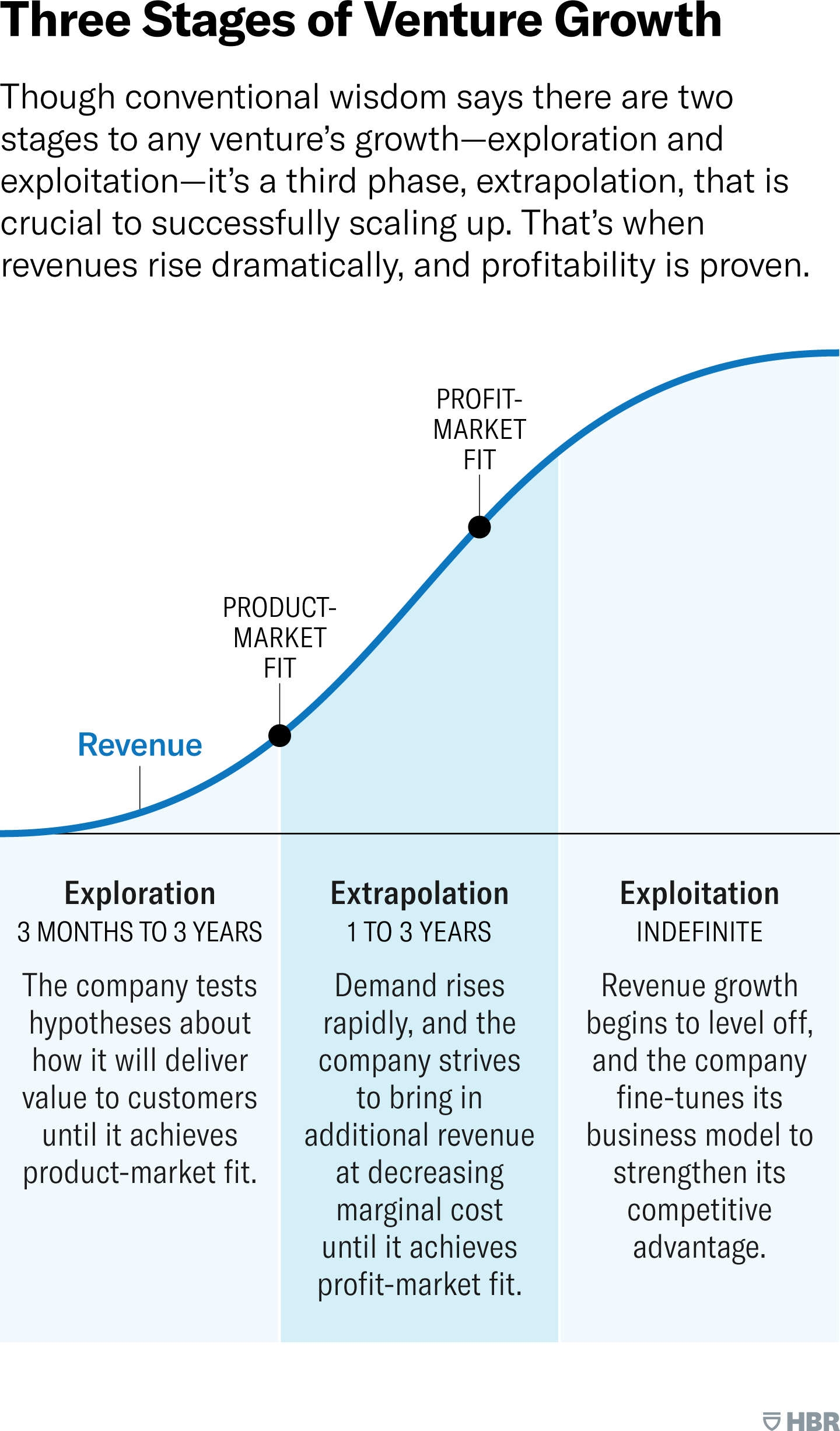

The conventional wisdom says growth should be the priority in a startup's early days. But emerging research suggests profitability should enter the picture sooner than most founders think.

Research shows that shifting to a profit focus earlier has benefits for startups down the road. An analysis of over 66,000 Finnish companies in the Journal of Business Venturing Insights found startups focused on profit earlier are more likely to perform better at both growth and profitability dimensions versus those chasing growth alone initially. It also found that profitability becomes increasingly more important as a company matures.

Another article from Harvard Business Review recommends startups focus on reaching "profit-market fit" after achieving "product-market fit". The findings suggest the importance of layering in profitability checkpoints even during high growth phases.

“The company must construct a business model that boosts revenue while reducing variable unit costs and containing fixed costs.” - Rayport et al

So under what circumstances does prioritizing profit make sense? Here are some key considerations:

Demand slows down - customer demand may change due to factors like economic conditions, industry headwinds, interest rates, etc. Slowing demand means that there’s less revenue growth potential, so it’s time to conserve runway

Access to funding is uncertain - When capital is scarce, investor sentiment shifts, or milestones for the next round look unattainable, focus on profitability can help extend runway

After core product validation - after demonstrating product-market fit and customer traction, it's time to refine the business model and path to profitability

Low margin business model - for startups competing on price and high volume vs. high margin, tracking and improving unit economics is crucial from the early stages

High customer acquisition costs - when the costs of acquiring customers are too high relative to customer lifetime value, it signals a need to focus on improving unit economics before aggressive growth

Lifestyle business goal - for founders not focused on building unicorns or billion-dollar exits, profitability may take priority

The key is assessing the internal and external constraints that may limit runway or growth potential, and determining whether a strategic pivot to profitability is appropriate given those circumstances.

When to prioritize growth?

While research shows focusing on profitability sooner has benefits, rapid growth should still be the top priority in a startup's earliest days. Here are some scenarios where focusing on rapid growth could be the wise strategic choice:

Fast-growing market - when the overall market is experiencing rapid adoption and growth, capitalize on the rising tide by fueling growth

First mover advantage - when it’s a disruptive innovation or new business model, grow to capture market share before competitors, especially if it’s a winner-take-all or winner-take-most market

Abundant capital - when funding is readily available and investors are prioritizing rapid growth, utilizing capital to aggressively expand rather than focusing on near-term profitability can align interests

Before product-market fit - when the product is still in development and product-market fit remains unproven, the focus should be on iterating, building, and finding traction

Network effect - for businesses that benefit from network effects such as marketplaces and social media platforms, unfavorable unit economics early on are typical and can be offset by focusing aggressively on growth. Focusing on growth to achieve scale can justify delaying profitability until the market is established

Economies of scale - for businesses like manufacturing and infrastructure with high fixed costs, growth is key even at a loss in order to reach economies of scale and drive down unit costs over time. The larger the scale, the higher the profitability

Adjacencies and new products - when new complementary products or markets significantly expand TAM, aggressively expanding to them before competition arises can be prudent

While rapid growth at the expense of profits can be strategically timed to capitalize on opportunities, growth cannot be sustained forever without eventual profitability. The key is evaluating whether the timing to reach profitability should be immediate or longer-term depending on factors such as those listed above.

What are examples of companies that focused on profit vs. growth first?

Let's look at some real-world examples of startups that prioritized growth first and those that prioritized profit.

Focused on Profit First:

Mailchimp - Mailchimp is an email marketing platform and has been profitable since its founding in 2001 with no venture funding. This approach allowed the company to maintain control of its business while steadily expanding its user base and offerings. By prioritizing profitability, MailChimp built a solid financial foundation. Mailchimp had about $800 million in revenue and was growing 20% year-over-year before being acquired by Intuit in 2021 for $12 billion

Klaviyo - founded in 2012 and initially bootstrapped after facing VC rejections, this marketing automation company achieved profitability within just three years since its inception in 2015. Only later did they take venture capital money to fuel further growth. Klaviyo's recent S-1 filing for an IPO reflects their transformation from what some might have considered a "lifestyle business" into a thriving multi-billion dollar marketing titan.

Prioritized Growth First:

Tesla - Tesla focused on rapid production expansion and new model launches over early profitability. This approach aligned with the capital-intensive nature of the automotive industry undergoing significant disruption. However, Tesla faced increasing pressure to become profitable as competition increased. It was not until 2020 that Tesla turned its first full-year profit, almost 17 years after being founded

Uber - Uber focused intensely on capturing market share in the ride-hailing industry during its early years. This growth-focused strategy was feasible given the new massive market opportunity and capital readily available. After 14 years and nearly $32 billion of cumulative losses, Uber has finally reported profit in Q2 2023

What growth and profitability metrics to track?

When is the right time to transition focus between scaling rapidly and optimizing for profit? Tracking and monitoring a range of metrics over time can provide valuable insights into the health and trajectory of a business.

Burn multiple - evaluate cash burn in relation to recurring revenue

LTV/CAC - assess the cost-effectiveness of customer acquisition. Delve deeper by examining its components, including churn and gross margin

CAC payback period - measure the time to recover customer acquisition costs

Sales cycle - track the time from lead to conversion

Rule of 40 - balance revenue growth and profitability metrics

Cash flow metrics - track metrics such as Operating Cash Flow and Free Cash Flow to gauge the company's ability to generate cash, which is vital for both growth and profitability

Conclusion

Growth is certainly table stakes for any startup. But finding the optimal balance between scaling rapidly and turning a profit requires assessing a startup's specific position and strategic priorities. While growth comes first in the earliest stages, the decision of when to shift focus to profitability is more art than science. It relies on deeply understanding the business model, industry dynamics, and long-term goals. Tracking key metrics like LTV/CAC and burn over time can provide valuable insights. Though there is no universal formula, the most successful startups thoughtfully sequence their stages, capitalizing on growth opportunities while maintaining the discipline to eventually transition to sustainable, profitable businesses.