The Subtle Art of VC Pitch: Leveraging Psychological Biases for Impact

5 Psychological Biases to Elevate Your Investor Pitch

Hi friends,

As an avid reader of social psychology content like the books Thinking Fast and Slow and Predictably Irrational, I'm fascinated by how our unconscious thinking shapes decisions. Given my role as a VC, I sometimes wonder how cognitive biases influence funding choices. Are founders aware of these biases? And are there ways to strategically tap into mental shortcuts and thinking patterns?

In this blog, I outline concepts from psychology that founders can use to their advantage. While passion and artistry set the tone, understanding the subconscious factors that sway VCs can enhance the impact of any pitch.

1. Cognitive ease: Things that are easier to understand seem more true → Simplify pitch and use contrasting colors

The human brain is lazy - in fact, studies have shown that as much as 95% of our brain activity is unconscious. The Nobel prize-winning psychologist Daniel Kahneman has extensively researched a phenomenon he calls cognitive ease, which refers to how easy or difficult it is for our minds to process information. When faced with a complex cognitive task, our brains unconsciously looks for mental shortcuts and heuristics to arrive at conclusions with the least effort. Kahneman suggests that we are primed to believe things we can process easily, even if they are unfounded.

So, how can this be applied to investor pitches? Through both verbal and visual:

Verbal: simplify your pitch

Rather than overloading potential investors with intricate product details upfront, simplify your pitch into an easy-to-follow story. I’ve often seen founders spending too much time explaining backend algorithms or models during intro calls. Unless prompted with these questions, save that deep dive for follow-up meetings and demos. The initial pitch is about making a compelling first impression and scheduling the next conversation.

Simplicity is the ultimate sophistication. - Leonardo da Vinci

Visual: Add contrasting colors to pitchdeck

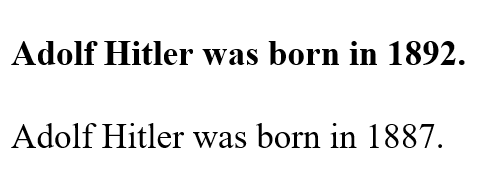

Another way to apply the concept is through playing with the visuals of your pitchdeck to make it more compelling. Consider an example below. Which do you believe is more true?

Both are false (he was born in 1889), but studies have shown that the first is more likely to be believed.

Maximize the contrast between characters and their background…You are more likely to be believed if your text is printed in bright blue or red than in middling shades of green, yellow, or pale blue. - Daniel Kahneman

Next time when creating a pitch deck, reconsider that baby pink or pale blue, even though they look pretty. Opt for high-contrast colors and bolded fonts instead.

2. Similarity bias: We prefer people who are similar to us → Find common ground with investors

Similarity bias leads people to favor those like themselves. A great example is where a study by Randy Garner shows recipients were twice as likely to complete a survey when the sender's name sounded like their own (ex: a woman named Cynthia Johnston getting a survey from someone named Cindy Johanson).

VCs are no different. Researchers Nikolaus Franke and colleagues found that VCs tend to favor teams that are similar to themselves in the type of training and professional experience. Another study by Charles Murnieks and colleagues found that VCs view opportunities more favorably when the founders ‘think’ in ways similar to their own.

While someone might not look similar to us in physical appearance or share the same gender or ethnicity, there are other ways to find common ground.

Research ahead of time and highlight shared experiences, interests, backgrounds, etc., especially great for small talk.

Study the investor’s investment thesis and the types of companies, sectors, and business models the investor has funded. Highlight how your company aligns.

Note any connections you have through the investor's portfolio companies, co-investors, school alumni, etc. Having mutual connections builds rapport.

If your product solves a problem they personally experience, use that to find a connection.

Avoid name-dropping or forced bonding. Conversations should flow and feel organic, not manufactured.

3. Halo effect: Tendency to like everything about a person based on your overall impression of them → Lead with your best

The halo effect is the cognitive bias where one positive attribute of a person or thing affects our perception of their other qualities more favorably. For example, if you perceive a person as warm and friendly, you might also think that he/she is intelligent, hard-working, and generous, even though these assumptions may not be accurate.

When pitching to investors, the halo effect can be used to your advantage. Remember that warm smile and open body language. Be sure to highlight your most significant strengths early on, such as your confidence, drive, or expertise.

4. Peak-end rule: people remember an experience by its peak and the end → Stir emotion and end your pitch strong

According to the peak-end rule, people tend to base their overall evaluation of an experience primarily on two key moments: the peak (the most intense or emotionally charged point) and the end (how the experience concluded). While the halo effect is about the overall impression of a person, the peak-end rule is about the overall impression of an experience.

So what does it mean for your pitch to enhance the memorability of the presentation?

Incorporate emotional elements in your pitch that resonate - sharing personal anecdotes or stories can create emotional peaks. Examples include the struggles you personally face that led you to start the company, your family background that led you to become passionate about the industry, or the positive impact you aim to make if the product has a social/environmental mission.

End on a high note by showing your passion, expressing excitement about working with the investor, and incorporating a call to action. With virtual meetings these days, many people have back-to-back meetings. It’s not uncommon for a call to end with a hurried, “Sorry, I have to hop to another call. I’ll follow up with an email”. Make sure you spend the last 30 seconds discussing clear next steps (ex: suggest a demo call, schedule an in-person coffee chat, send data room).

5. Social proof - People look to the behavior of others to guide their own actions → Incorporate case studies and reviews

Barbie dolls, Animal Crossing, Pokémon Go. Looking back, why are we playing these? Well, because everyone else is. Social proof is a psychological phenomenon where people rely on the actions and decisions of others to guide their own behavior, especially in uncertain or unfamiliar situations.

Social proof can be immensely powerful. Here are several ways it can be incorporated into investor pitches and decks:

Add logos of major customers, partners, and brands.

Incorporate stats on active users or growth metrics. A large user number shows social validation.

Share case studies and customer testimonials that convey satisfaction and ROI.

Include press mentions, awards, or customer ratings from trusted third parties.

Note investments from other respected VCs and angels.

The key is leveraging social proof to make investors feel confident to be part of the growing momentum you’re building!

In conclusion, while leveraging cognitive biases can be helpful tools for enhancing your investor pitch, they should complement your pitch - you still need to do the groundwork of mastering the fundamentals. Avoid overusing psychological tactics in a manipulative way. When they are woven into an authentic, well-rehearsed pitch, insights from psychology can help you connect with investors in a more nuanced, memorable way.

Genuinely an interesting post! The first and second points hit me pretty hard. Even though I am not in this space but still applicable to presentations or discussions during work!

I just got a Kobo recently. Gonna checkout the book you mentioned in the post, Thinking Fast and Slow and Predictably Irrational!

Such a good read!